The recent collapse of FTX, one of the largest cryptocurrency exchanges valued at $32 billion, has sent shockwaves throughout the crypto industry. This unfortunate event has once again highlighted the need for a reliable method to evaluate the solvency of cryptocurrency exchanges. To address this issue, researchers from the Complexity Science Hub (CSH), in collaboration with the Financial Market Authority (FMA) and the Austrian National Bank (OeNB), have put forth a new approach in a working paper titled “Assessing the Solvency of Virtual Asset Service Providers: Are Current Standards Sufficient?”

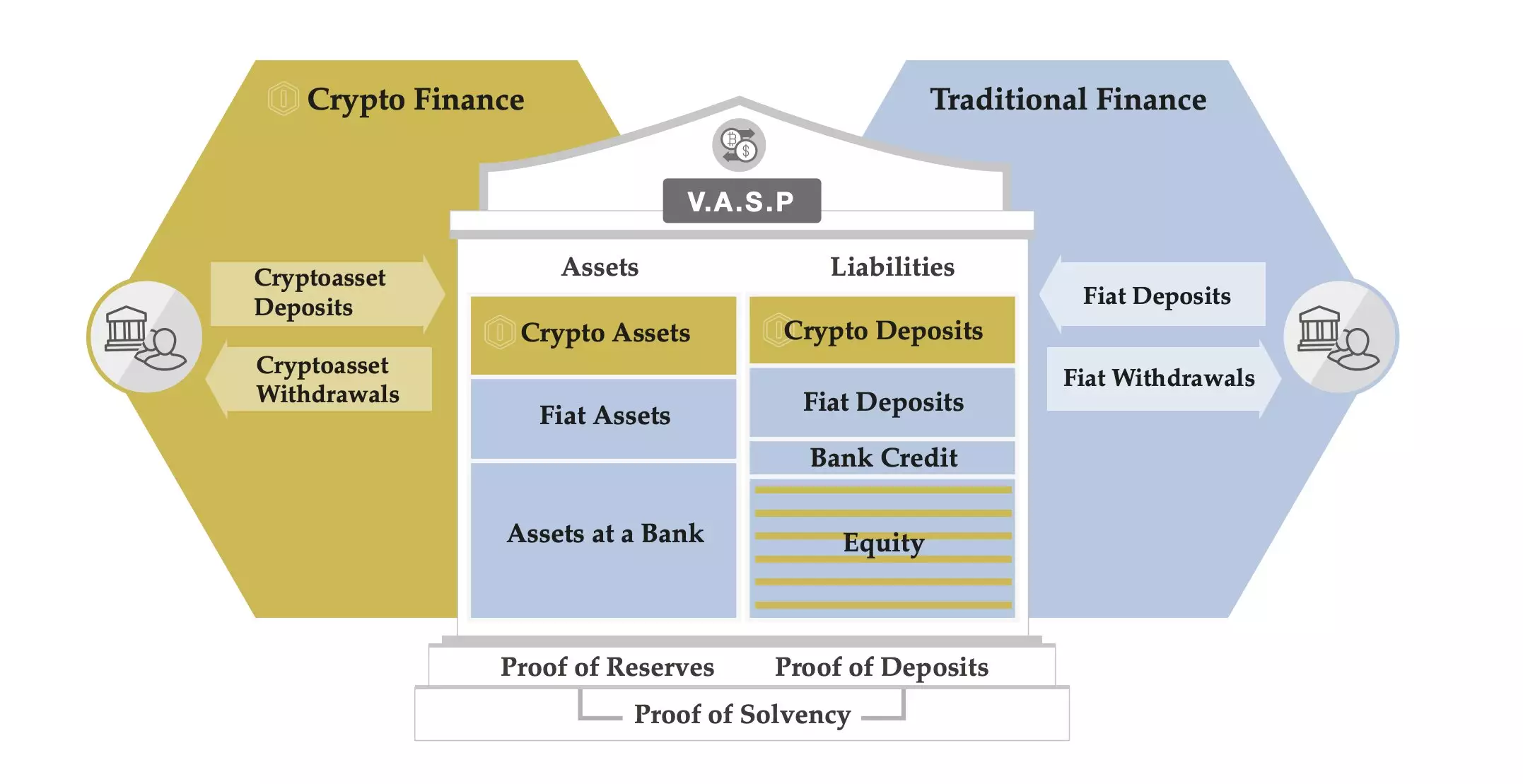

Traditional financial institutions have well-established solvency assessment procedures in place. However, the evaluation of solvency among virtual asset service providers (VASPs) in the crypto industry is conducted in an ad-hoc manner and lacks a systematic approach. This is mainly due to the nature of cryptocurrencies, where assets are held in pseudonymous wallets on different blockchains and are not fully disclosed in available reports such as balance sheets.

Bernhard Haslhofer of the Complexity Science Hub emphasizes the importance of new solvency assessment methods for cryptocurrency exchanges, citing the FTX insolvency as a prime example. Sam Bankman-Fried, the founder of FTX, was recently found guilty of money laundering and fraud, among other charges. It was alleged that he diverted around $14 billion of FTX customer funds to his own investment fund, Alameda Research.

The researchers propose two key measures to enhance solvency assessment in the crypto industry. Firstly, VASPs should disclose their crypto asset wallet addresses and provide additional metadata describing the usage of these wallets. This would enable independent auditors to verify whether a VASP has access to the funds associated with its on-chain wallets.

Secondly, VASPs should separate their balance reports into crypto and fiat assets and report them at appropriate intervals. By doing so, regulators and auditors would have a clearer understanding of the proportion of assets held in traditional currencies versus cryptocurrencies. Currently, the lack of separation makes it challenging to assess the overall solvency of VASPs.

The researchers conducted a comprehensive analysis of 24 VASPs registered with the Austrian Financial Market Authority. They compared data from the VASP’s known crypto asset wallets, balance data from the trade register, and information from regulatory authorities.

The study revealed that the known crypto asset holdings and the reported balance data were only partially consistent. There were three main factors contributing to this inconsistency. Firstly, not all VASPs segregate their balance sheets for crypto and fiat assets, making it difficult to evaluate the proportion of assets from each category. Secondly, VASPs adopt varying approaches to manage their crypto asset transactions. And thirdly, the crypto asset holdings of VASPs are not easily visible to external parties.

The collapse of FTX serves as a stark reminder that crypto companies can face insolvency, potentially resulting in significant losses for their customers. The study conducted by the Complexity Science Hub and its collaborators aims to improve the analysis and evaluation of VASP solvency in the future.

By implementing the proposed measures, namely the disclosure of wallet addresses and the separation of balance reports, the transparency and accountability of cryptocurrency exchanges can be enhanced. Through increased visibility into asset holdings and standardized reporting, regulators and auditors will be better equipped to assess the solvency of VASPs and protect the interests of customers.

The collapse of FTX has shed light on the urgent need for improved solvency assessment methods for cryptocurrency exchanges. The study conducted by the Complexity Science Hub and its partners provides valuable insights and recommendations for evaluating the solvency of VASPs. With the implementation of these measures, the crypto industry can work towards building a more robust and trustworthy ecosystem for all participants involved.

Leave a Reply