Artificial intelligence (AI) has gained significant attention as a potential solution to complex modeling problems. From investment banking to risk management, AI has been explored in various domains. However, amidst the positive reports, concerns have been raised regarding its practical applicability, particularly in hedging derivative contracts. In a recent study published in The Journal of Finance and Data Science, researchers from Switzerland and the U.S. delved into the use of reinforcement learning (RL) agents to hedge derivative contracts. This article critically analyzes the study, showcasing both the benefits and limitations of AI in this context.

The researchers acknowledge that training an AI on simulated market data can yield promising results. However, the practicality of applying such trained models to real-world derivative markets becomes questionable due to the scarcity of training data. AI systems are notorious for their insatiable data consumption, making it challenging to gather enough market data for training. Consequently, researchers often resort to assuming an accurate market simulator to train their AI agents. Yet, this approach encounters a classic financial engineering problem—selecting a model to simulate from and calibrating it. The reliance on simulation and calibration makes the AI-based approach akin to traditional Monte Carlo methods that have been in use for decades.

To tackle the limitations posed by training data, the study adopted a Deep Contextual Bandits approach. These techniques are renowned in RL for their data-efficiency and robustness. Moreover, the model was designed to align with the operational realities of real-world investment firms. It incorporated end-of-day reporting requirements and had substantially lower training data needs compared to conventional models. This adaptability to changing markets and reduced data requirement made the model more practical for application in the industry. “One of the strengths of the newly developed model is that it conceptually resembles business operations at an investment firm and thus is applicable from a practical perspective,” asserts senior author Oleg Szehr.

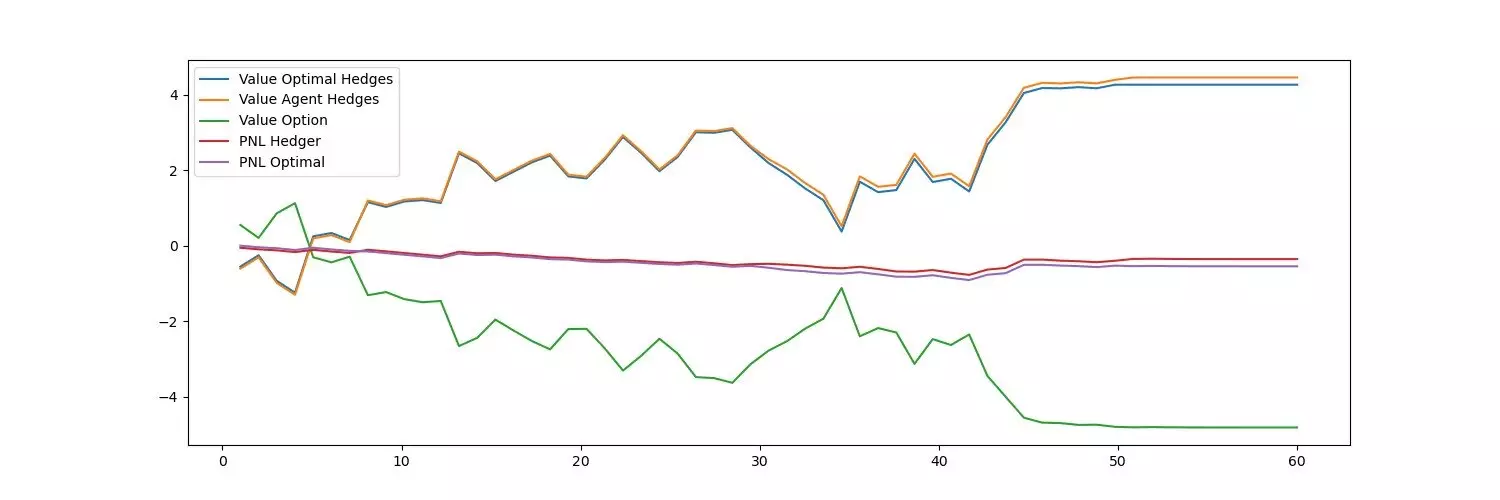

Despite its simplicity, the newly developed method exhibits superior performance compared to benchmark systems, as demonstrated through rigorous assessments. Efficiency, adaptability, and accuracy were key factors where the new method surpassed existing models. The old adage “less is more” rings true in risk management, and this principle applies to the new model in derivative contract hedging. By capturing the essential aspects of risk management and aligning with real-world operational requirements, the new method offers a practical solution.

One of the critical drivers in determining the success of AI applications in the banking industry is data availability. The study highlights that the availability of data and operational realities, such as end-of-day risk reporting requirements, heavily influence the practical implementation of AI models in investment banks. While ideal agent training is desirable, the limitations of data availability often shape the actual work done in banks. Therefore, it is essential to design AI models that can operate efficiently under these constraints, as the newly developed method aims to do.

The study sheds light on the potential benefits of AI in derivative contract hedging while critically addressing its limitations. The scarcity of training data and the challenges of aligning AI models with real-world operations pose significant hurdles. However, the new method based on Deep Contextual Bandits shows promise by offering a simpler yet more effective approach. By focusing on efficiency, adaptability, and accuracy, the model outperforms benchmark systems under realistic conditions. As AI continues to evolve, striking a balance between technological advancements and practical considerations will be crucial in harnessing its full potential in the financial industry.

Leave a Reply