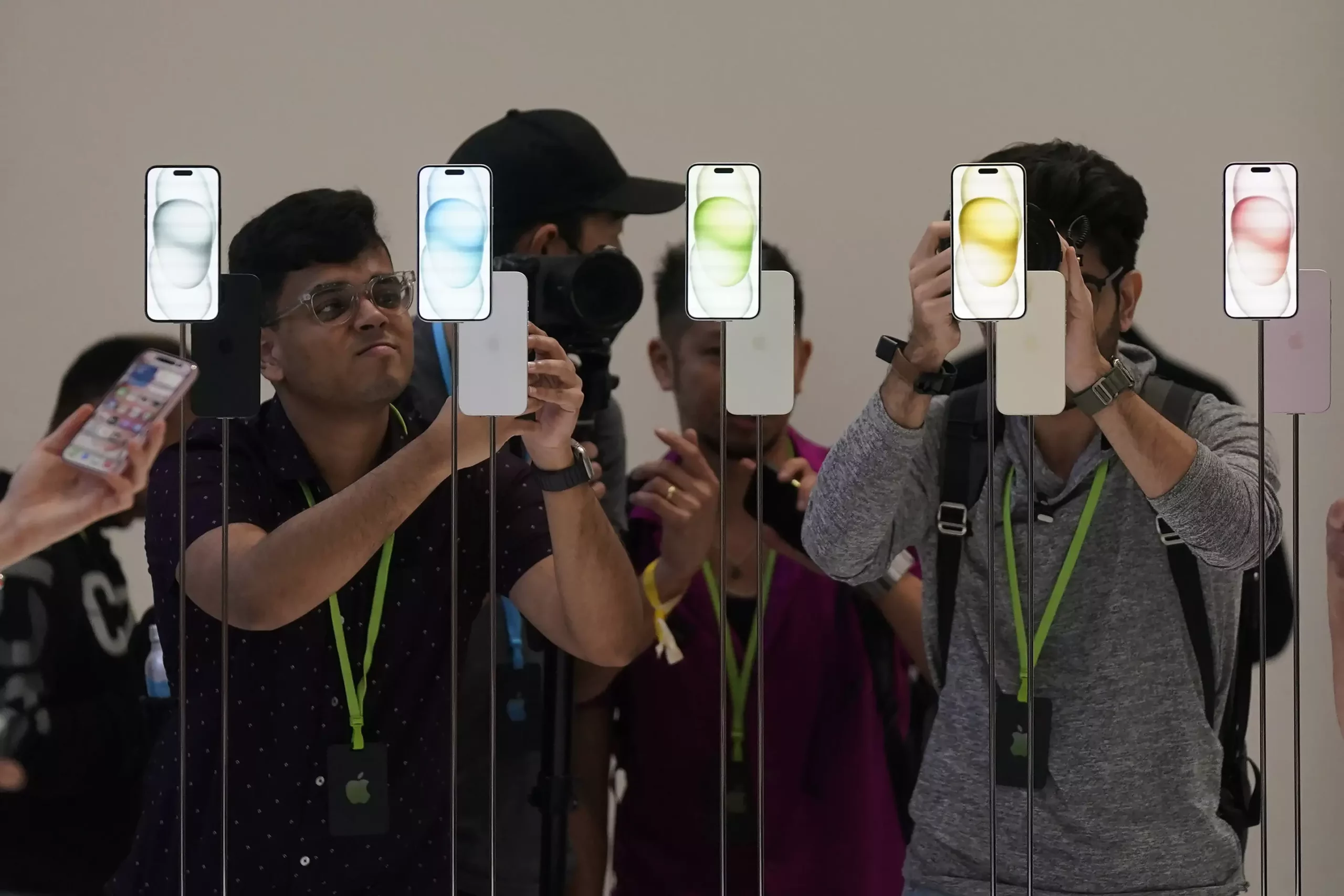

Apple, the tech giant that needs no introduction, has recently shown signs of snapping out of a yearlong sales slump. With solid demand for its latest iPhone model and continued growth in its services division, Apple is striving to regain its momentum as the most valuable publicly traded company in the United States. However, despite a modest revenue growth and optimistic projections from CEO Tim Cook, concerns still linger about Apple’s ability to sustain its growth trajectory in the face of legal challenges and market fluctuations. In this article, we will delve into Apple’s recent financial performance, assess the impact of its new product releases, and evaluate the hurdles it must overcome to secure its position as an industry leader.

Apple’s revenue for the October-December quarter in 2021 rose by 2% compared to the previous year, reaching an impressive $119.58 billion. The company also saw a 13% increase in earnings, amounting to $33.92 billion, or $2.18 per share. The iPhone, as the staple product in Apple’s lineup, remained the primary driver of revenue growth, with sales totaling $69.7 billion. Additionally, the services division, closely tied to the iPhone ecosystem, experienced an 11% revenue rise to $23.12 billion. These figures exceeded analysts’ projections, as reported by FactSet Research. However, despite the positive results, Apple’s stock plummeted over 3% in after-hours trading due to a lukewarm forecast for the upcoming quarter, raising concerns about the company’s future prospects.

In an effort to shift the narrative and regain its footing, Apple released the Vision Pro headset, promoting it as a revolutionary advancement in spatial computing. This hybrid device aims to immerse users in a seamless blend of physical and digital environments. However, with a hefty price tag of $3,500 for the initial version, analysts anticipate that demand may be constrained, thereby posing a challenge to Apple’s sales growth this year. The success of the Vision Pro will determine whether Apple can reclaim its title as the most valuable U.S. publicly traded company.

While Apple’s services division has been a consistent performer, generating double-digit revenue growth, it now faces significant legal challenges that could impact its financial standing. The company’s agreement with Google to make it the default search engine on iPhones and Safari browser has become the focal point of a high-stakes antitrust case brought forth by the U.S. Justice Department. With an estimated annual revenue of $15 billion to $20 billion at stake, this legal battle could lead to substantial financial repercussions for Apple. Additionally, the iPhone app store, a vital component of Apple’s services division, has faced scrutiny, including an antitrust case brought by video game maker Epic Games. As a result, Apple has been forced to revise its commission system, but critics argue that these concessions are inadequate, thereby pushing for further regulatory changes.

Another area of concern for Apple is its faltering sales in China, a crucial market for the company. The drop of 13% in revenue from the previous year to $20.82 billion underscores the challenges Apple faces in this region. China’s economic slowdown and reports suggesting potential restrictions on workers from purchasing iPhones have contributed to this decline. The unpredictable Chinese market poses a significant risk, and Apple must navigate these obstacles to maintain its global prominence.

Apple’s recent financial performance offers a glimmer of hope after a yearlong sales slump. The demand for its latest iPhone model, coupled with growth in the services division, has provided a temporary respite. However, uncertainties prevail, ranging from legal challenges threatening revenue streams to market fluctuations impacting sales in vital regions like China. Apple’s ability to overcome these challenges will define its future trajectory in a highly competitive tech landscape. As the company aims to regain its status as the most valuable U.S. publicly traded company, it must embrace innovation, navigate legal complexities, and adapt to changing market dynamics to secure its position as a global industry leader.

Leave a Reply